Not known Facts About Pvm Accounting

Not known Facts About Pvm Accounting

Blog Article

Rumored Buzz on Pvm Accounting

Table of ContentsThe Of Pvm AccountingThe Of Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.Little Known Questions About Pvm Accounting.The Pvm Accounting PDFsThe 9-Minute Rule for Pvm Accounting

Ensure that the accounting process conforms with the legislation. Apply called for building accounting requirements and procedures to the recording and reporting of construction activity.Understand and keep common expense codes in the accounting system. Communicate with various financing firms (i.e. Title Business, Escrow Company) relating to the pay application process and needs needed for payment. Manage lien waiver disbursement and collection - https://leonelcenteno.wixsite.com/pvmaccount1ng/post/unlocking-the-secrets-of-construction-accounting. Monitor and fix bank problems including cost anomalies and examine differences. Aid with applying and preserving interior economic controls and procedures.

The above statements are planned to describe the basic nature and level of work being done by individuals assigned to this classification. They are not to be taken as an exhaustive listing of duties, responsibilities, and abilities called for. Personnel may be called for to perform obligations beyond their typical responsibilities every now and then, as required.

4 Simple Techniques For Pvm Accounting

You will certainly help sustain the Accel group to make certain distribution of successful on time, on spending plan, jobs. Accel is seeking a Building Accounting professional for the Chicago Office. The Building Accounting professional executes a range of accounting, insurance conformity, and task administration. Functions both separately and within certain divisions to maintain financial documents and make sure that all records are maintained current.

Principal obligations include, however are not restricted to, managing all accounting features of the business in a timely and precise manner and providing reports and timetables to the company's CPA Firm in the preparation of all monetary declarations. Makes certain that all bookkeeping treatments and features are handled accurately. In charge of all financial documents, pay-roll, banking and daily operation of the accounting function.

Functions with Job Managers to prepare and publish all monthly invoices. Produces monthly Job Expense to Date reports and working with PMs to resolve with Task Managers' spending plans for each job.

Rumored Buzz on Pvm Accounting

Proficiency in Sage 300 Building And Construction and Realty (previously Sage Timberline Office) and Procore construction management software program an and also. https://www.ted.com/profiles/46928939. Must additionally excel in other computer software systems for the preparation of reports, spread sheets and various other audit evaluation that may be called for by management. construction accounting. Have to possess strong business abilities and capability to prioritize

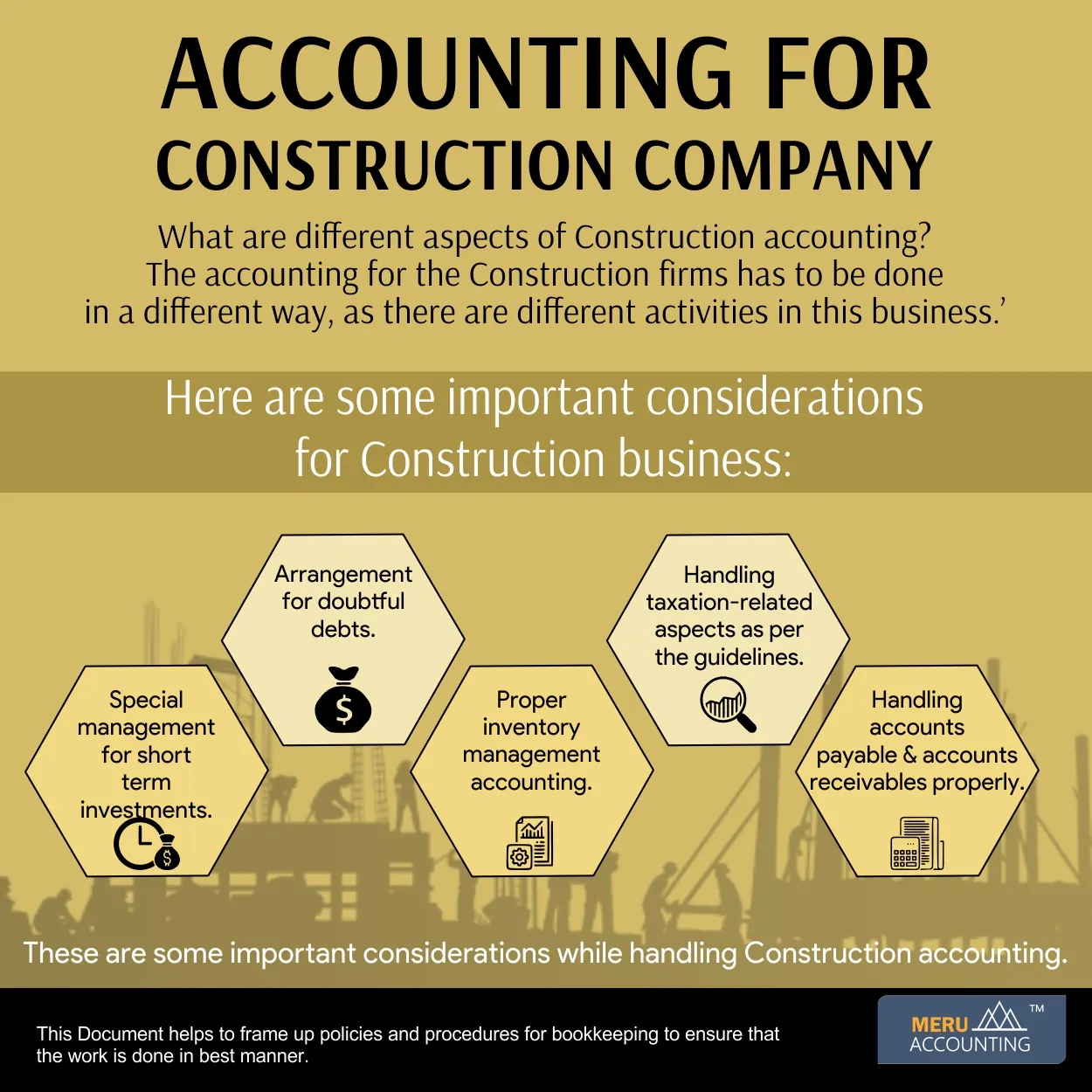

They are the monetary custodians that make sure that building projects continue to be on budget plan, adhere to tax laws, and maintain monetary transparency. Building and construction accountants are not just number crunchers; they are critical companions in the construction process. Their key role is to manage the economic facets of construction projects, guaranteeing that resources are alloted efficiently and economic threats are reduced.

Pvm Accounting Can Be Fun For Anyone

By preserving a tight grasp on project finances, accounting professionals assist stop overspending and monetary problems. Budgeting is a cornerstone of successful construction tasks, and construction accountants are critical in this regard.

Building and construction accountants are skilled in these guidelines and guarantee that the job abides with all tax obligation requirements. To succeed in the role of a building accountant, people need a strong educational foundation in accountancy and finance.

Additionally, certifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building Market Financial Specialist (CCIFP) are highly pertained to in the industry. Working as an accountant in the building and construction industry features visit site an unique set of obstacles. Building and construction tasks typically include limited due dates, altering policies, and unforeseen expenditures. Accounting professionals have to adjust promptly to these challenges to maintain the task's monetary health intact.

Things about Pvm Accounting

Professional certifications like certified public accountant or CCIFP are additionally highly advised to show experience in construction accounting. Ans: Building and construction accounting professionals develop and keep an eye on budgets, recognizing cost-saving possibilities and making sure that the project remains within spending plan. They likewise track expenditures and forecast financial requirements to avoid overspending. Ans: Yes, construction accounting professionals handle tax conformity for building and construction tasks.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make challenging options among numerous monetary options, like bidding process on one task over another, picking funding for products or tools, or setting a project's earnings margin. In addition to that, building and construction is a notoriously volatile sector with a high failing price, sluggish time to repayment, and inconsistent cash circulation.

Typical manufacturerConstruction organization Process-based. Production involves repeated procedures with easily recognizable expenses. Project-based. Manufacturing needs various procedures, products, and devices with differing expenses. Fixed area. Manufacturing or production happens in a solitary (or several) regulated areas. Decentralized. Each job happens in a brand-new place with varying site problems and one-of-a-kind obstacles.

A Biased View of Pvm Accounting

Resilient relationships with vendors alleviate arrangements and enhance performance. Irregular. Constant use various specialized contractors and suppliers impacts performance and capital. No retainage. Repayment shows up completely or with routine repayments for the full contract amount. Retainage. Some part of settlement might be held back till project conclusion also when the contractor's work is finished.

Normal production and short-term agreements result in workable cash circulation cycles. Irregular. Retainage, sluggish settlements, and high ahead of time prices bring about long, irregular cash circulation cycles - financial reports. While typical suppliers have the advantage of regulated settings and maximized production procedures, construction firms should continuously adapt to each brand-new task. Even somewhat repeatable jobs call for modifications due to website problems and other factors.

Report this page